How consumers are redefining customer experience

How consumers are redefining CX

In their 2019 Global Consumer Insights Survey, PwC introduces the concept of “ROX” as a way for companies to measure their success on the metric of customer experience.

The following article on customer experience first appeared on www.pwc.com.au on 26 Mar 2019. Author Chris Paxton

Customer Experience (CX) Key takeaways

- Customers are embracing technology in their pursuit of online goods and services.

- Brands wanting to increase spend and frequency should focus on the changing nature of customer experience.

- Friction-less interactions that integrate with a customer’s daily life and technology are key.

Is experience really everything? Yes, according to respondents of PwC’s 10th annual Global Consumer Insights Survey (GCIS).

Canvassing more than 21,000 consumers from 27 territories, the survey found consumers the world over want good customer experience when they shop. And what’s more, with the technology they have access to, they can now demand it.

On their wish list is an experience that is curated, channel-agnostic, socially conscious and social-media-powered. For some businesses, this is a tall order, and not one that has gotten enough attention in the past. Gone are the days when a pleasant smile is enough to gain customer favour.

Consumers, with technology at their fingertips, are redefining what good customer experience means.

Living digital

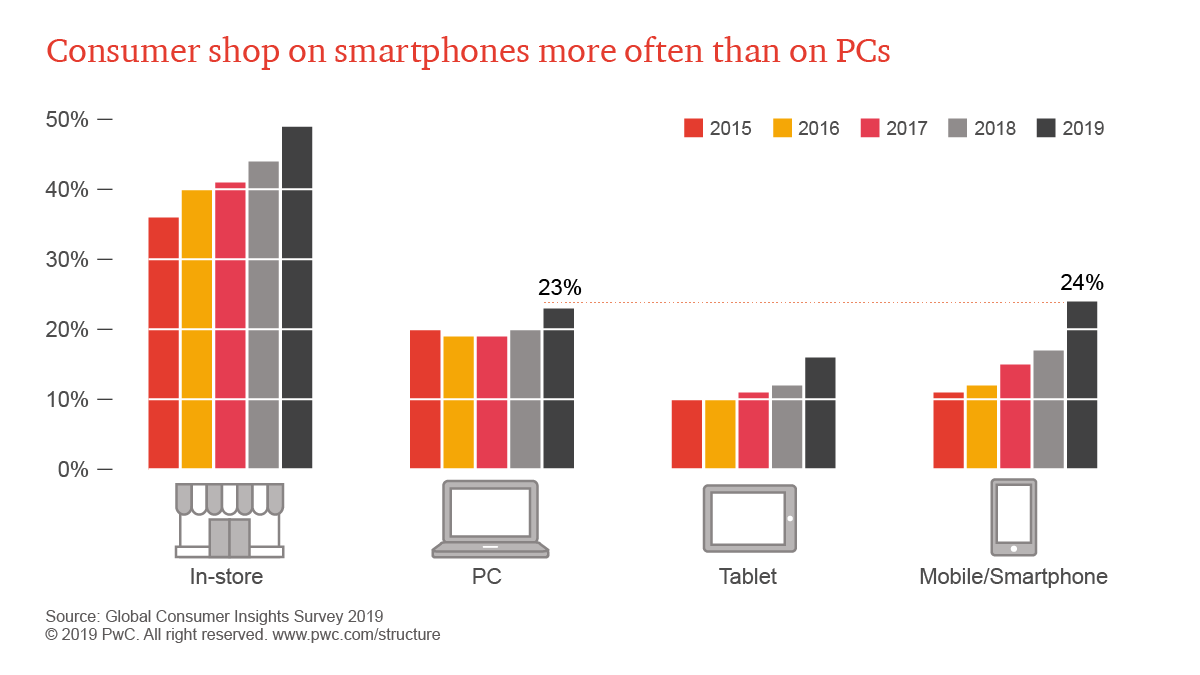

Technology is infiltrating daily life at breakneck speed. Mobiles, tablets and PCs are all being used for online shopping. This year, for the first time since the study has been run, mobiles overtook all other digital devices as the preferred shopping tool. Smartphones were reported as the go-to tech for purchasing, with 24% of respondents using a phone to shop at least weekly. The trusty PC is still close, though falling in favour, at 23% of consumers, while tablets bring up the rear at 16%

Online shopping is now the norm, with only 7% of people saying they never purchase products online.

As anyone who has coached a tech-wary relative on the ease of online banking can attest, people eventually become comfortable with the online experience. Over half of those surveyed paid bills or invoices online in the last year, with similar numbers transferring money. Entertainment, such as streaming movies and TV, is also booming, with 54% watching two to three times a week or more (over half of Gen Z streams daily).

Smartphones are also increasingly being used for payment, particularly in emerging regions where mobile phone use has leapfrogged traditional landline systems. While the technology’s prevalence is different depending on the country, globally, 34% of consumers have paid for a purchase via their mobile in 2018, up 10% on the previous year.

Frictionless shopping

Newton’s first law of motion states that a body in motion will continue to remain in motion until it is acted upon by an external force, that is, until it encounters friction. Customers, it turns out, are much the same. The less friction in their purchase journey, the more they’ll shop, and the more they’ll spend. Thirty-four percent of those surveyed said they shop more frequently due to having used Amazon, suggesting the experience – and likely its ease – encourages online shopping.

Voice assistants, such as Google Home or Amazon’s Alexa, are increasingly relevant to online shoppers with their AI hearts built around predictive, frictionless interaction (even if reality is still catching up with the promise). Nine percent of the global sample said they use the technology weekly or more. As the report notes, however, “as shopping by voice continues to catch on, companies should be thinking beyond mobile to consider how voice technology in homes, cars, and elsewhere will affect customer experience”.

Anything that adds friction will not be looked upon kindly. Click-and-collect functions, already adopted by 42% of Australian retailers, are gaining favour in the US (under the acronym BOPUS, or ‘Buy Online and Pick Up in Store’), but customers need to be helped through the experience before they will trust it – and that’s where employees come in.^

The human-digital touch

While customers want to interact with brands via digital means, this doesn’t mean they want humans out of the picture entirely.

This year, smartphones have proven more popular than PCs when it comes to purchasing online, but in-store shopping is still popular. How can brands manage the mix of in-person and digital experiences?

This year, smartphones have proven more popular than PCs when it comes to purchasing online, but in-store shopping is still popular. How can brands manage the mix of in-person and digital experiences?In PwC’s Consumer Intelligence Series report on customer experience last year we found that 59% of those surveyed believed that companies had lost touch with the human element by focusing too much on tech. One of the takeaways was that brands needed to have a good mix of technology and staff, and in particular, have tech that empowered employees to provide superior service.This finding is echoed in the current survey, particularly as regards financial services, where only 15% had purchased insurance via a digital channel, only 13% had gotten a loan and only 12% made a financial planning decision. For this industry, and others, more education is required by the customer before they feel comfortable in making a purchase. A blended experience, where in-person interaction is mixed with digital experiences throughout the journey, can prove far more fruitful in these instances.

Dreaming big

When it comes to redefining customer experience, it is also apparent that not only are consumers increasingly more willing to try online purchasing, they’re ready to increase what they do online in other ways. Almost 75% of consumers have installed as many as three health or wellness apps on their phones, and two-thirds of those surveyed are willing to access such services through nontraditional players – such as Facebook, Apple or Amazon.

Health and wellness apps are enjoying wide adoption by consumers – particularly for weight loss and exercise.

Health and wellness apps are enjoying wide adoption by consumers – particularly for weight loss and exercise.

Health is not the only example when it comes to pushing traditional boundaries. Forty-six percent of consumers would like to have, or will consider having, an autonomous vehicle. Fifty-eight percent would consider investing in or using bitcoin or another digital currency.

It’s clear that customers are expanding their digital horizons and, as they explore, their expectations will grow with them. For brands, this means delivering a superior customer experience the entire length of the journey customers take.

Sources

This article was originally published on www.pwc.com.au. For all the insights from the Global Consumer Insights Survey, download the full report here.

^ https://www.abc.net.au/news/2017-08-30/click-and-collect-why-retailers-are-pushing-shoppers/8856504