News

News

Protecting your digital identity

During this Scams Awareness Week, we’re sharing our top tips to combat scams. Following on from Safeguarding older and vulnerable individuals from scams today we bring you the next tip in our series.

Tip 2: Protect your data like you protect your wallet!

Financial institutions spare no effort in combating fraud and protecting their customers from scammers, and there are thousands of people working around the clock to protect you and your money.

However, in recent years scammers have realised they are competing with advanced multimillion-dollar fraud detection controls and systems, and therefore the path of least resistance is to trick customers into helping them bypass the fraud controls that are put in place for customer protection.

The truths we must acknowledge:

1. Scammers already have some of your data

There’s an alarming amount of compromised data out there, and scammers are becoming increasingly skilled at exploiting it. The numerous Australian data breaches publicised widely are just the tip of the iceberg.

You can check how many data breaches have involved your details at this website: https://haveibeenpwned.com/

2. If you think you are too smart to be scammed, you are a great target!

Scammers, armed with your stolen data, can piece together a comprehensive profile of their targets. That seemingly innocent chat on WhatsApp or a transaction on Facebook Marketplace can be a data-mining expedition. This, in turn, can be exploited to build trust and manipulate people into compliance.

The following are some steps you can take to shield yourself from scams:

- Stay informed: Learn from the experiences of scam victims, by putting yourself in the victim’s situation and considering how the controls you have in place could have protected you in their situation.

- Limit personal information sharing: Be cautious about the amount of personal information you share on social media ,and tighten your security settings. The less scammers know about you, the harder it is for them to craft convincing scams.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for your online accounts. This adds an extra layer of security, making it significantly more difficult for scammers to gain access to your accounts.

- Have strong, unique passwords: Don’t underestimate the importance of strong, unique passwords for each of your online accounts. Consider using a reputable password manager to help you generate and store them securely.

Your data is your digital identity, and safeguarding it is vital. Scammers can use your data to gain trust, manipulate, and exploit vulnerabilities.

By taking steps to protect your data and sharing this knowledge with others, we can collectively defend against data-driven scams and build a safer digital world.

Safeguarding older and vulnerable individuals from scams

Australians have lost $430 million to scams already in 2023, and as Christmas approaches, we can expect another spike in scam activities.

Here’s our top tips to combat scams.

Tip 1: Safeguarding older and vulnerable individuals

Equipping ourselves and our loved ones with the knowledge needed to fend off scams is crucial.

In this digital age, scams can affect anyone, regardless of age or technological know-how. However, older, and more vulnerable individuals tend to fall prey to scams more often.

In 2023, Australians over 65 have lost more than $108 million to scams and represented one in four of all scam reports.

To combat scams effectively, it’s important to educate those at higher risk of becoming a victim. Sharing our knowledge, experiences, and staying vigilant empowers them to recognise and respond to potential threats.

Here are a few suggestions on how we can play a vital role in protecting our loved ones:

Initiate conversations

Be a trusted, non-judgmental resource available at any hour of the day. Engage in open discussions with older family members, friends, and acquaintances about the potential dangers lurking online. Encourage them to ask questions and share their concerns.

Teach them to identify red flags

Educate older individuals about common scam warning signs such as unsolicited calls, suspicious emails, requests for personal information, or high-pressure sales tactics. Equipping them with this knowledge improves their confidence in navigating scam scenarios.

Encourage scepticism

Encourage healthy scepticism and a “trust but verify” approach when encountering unknown or unfamiliar entities. Remind them to independently verify the legitimacy of offers, requests, or investments before committing to any action.

If it doesn’t feel right, JUST HANG UP!

Phone scams result in more monetary loss than any other method. If someone on the phone is making them uncomfortable or is moving too fast, they can always hang up! Scammers feed on people’s politeness. It’s better to risk offending someone than to risk a scammer taking all of your hard-earned money.

We encourage you to share with your vulnerable loved ones so that we can all be protected.

Let’s work together to ensure we’re all protected from the harms of scams. By extending our helping hands, we can make a significant impact in their lives and collectively build a stronger and safer community.

For additional information on supporting scam victims, visit the Scamwatch website: https://www.scamwatch.gov.au/protect-yourself/help-someone-whos-being-scammed

Read more scam-busting tips:

Celebrating 20 Years Stellar Years: Orion Financial Crimes.

Two decades ago, a journey began that would change the landscape of financial security. Today, we are celebrating 20 Stellar Years of Orion Financial Crimes—a journey marked by relentless dedication, innovation, and unwavering commitment.

The Origin: A Small Beginning with a Vision

Our story starts with ‘Credit Link,’ a small organisation consisting of just 30 staff members. Within its portfolio were 12 Visa Debit Card clients. However, a significant challenge arose when Visa decided to decommission its daily report of unusual transactions—an essential tool for fraud detection. This left a void that needed to be filled, and Credit Link was ready to step up to the challenge. Credit Link, now proudly known as Indue, embarked on a transformative journey by opting into First Data’s hosted PRM offering. This move was revolutionary in the world of fraud software, marking the beginning of a new era in financial security.

A Critical Decision: Developing a Service Offering

To meet the evolving needs of our clients and enhance their financial security, Indue made a critical decision. We decided to develop a service offering that would not only address the existing challenges but also set new standards in the industry.

Within the first year, our team expanded from 1 Full-Time Equivalent (FTE) to 3 FTE, allowing us to extend our service hours significantly. We went from operating on weekdays from 8 am to 4 pm to a more expansive schedule, covering hours from 7 am to 6 pm, including Saturday mornings.

The Financial Landscape: Then and Now

Looking back, it’s astonishing to see how the financial landscape has evolved over the past two decades. When we began, there were no overnight services, no real-time decline mechanisms, and no investigation case management tools. Transactions were predominantly conducted using magnetic stripe cards with signatures, and concepts like ‘chip and pin’ and ‘Visa Secure’ were yet to emerge. The primary focus of fraud prevention was on card-present scenarios, primarily

countering counterfeit activities. Today, e-commerce fraud, which now dominates the fraud landscape, was not even officially categorised.

Our Unchanging Purpose: Effective Mitigation and Exceptional Service

Throughout the challenges and transformations, our purpose remained constant—to achieve effective and efficient fraud mitigation while delivering exceptional customer service. We navigated uncharted waters, developing processes, procedures, reports, and client engagement strategies on the fly. All of these were driven by our sole aim: to enhance financial security while ensuring our clients’ competitiveness.

A Journey of Transformation and Innovation

As we celebrate 20 stellar years, we take pride in our journey of transformation, innovation, and unwavering commitment to financial security. From a small team managing a handful of clients to becoming a leading force in fraud detection and prevention, our story is one of dedication and excellence. We extend our heartfelt gratitude to our dedicated team, both long-serving members and newcomers, for their continuous efforts in driving positive change. To our clients, who have placed their trust in us for two decades, we say thank you.

Your support has been instrumental in our journey.

As we look ahead, we remain committed to advancing financial security, embracing emerging technologies, and strengthening our partnerships. Orion Financial Crimes, powered by Indue, stands as your reliable financial guardian, safeguarding your assets from harm.

Here’s to celebrating 20 Stellar Years of excellence, and to many more years of securing your financial transactions. Thank you for being part of our remarkable journey.

Find out more about our Orion Financial Crime solution.

Fraud Statistics Jan 22 – Dec 22

According to the 2023 Australian Payment Fraud Report, in 2022, fraud on payment card transactions increased by 16.5% on the previous year to $577 million, in line with the increase in total spending on cards, which was up by 16% to $1 trillion over the same period. The rate of fraud on Australian card payments was 57.5 cents per $1,000 spent, up slightly from 57.3 cents in 2021.

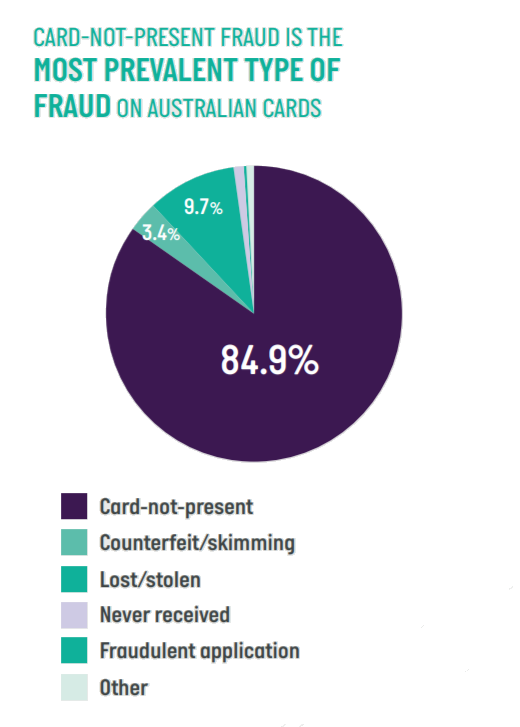

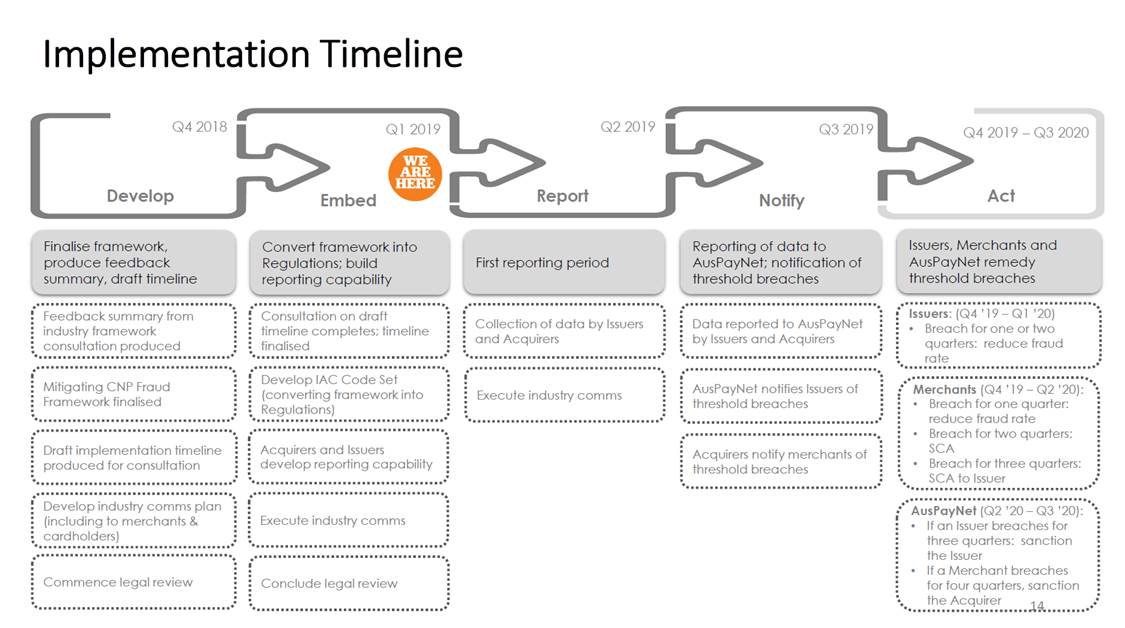

The data indicates that the fraud rate has stabilised since the introduction of the industry’s card-not-present (CNP) Fraud Mitigation Framework (CNP Framework) in 2019, with the 2022 fraud rate remaining well below the fraud rate of 75.0 cents per $1,000 spent in 2017.

The CNP Framework requires merchants who consistently exceed agreed fraud threshold targets to strengthen customer authentication and apply other measures. The framework also encourages secure technologies such as real-time monitoring, machine learning and tokenisation.

AusPayNet sponsors the Economic Crime Forum (ECF), which brings together industry, law enforcement and government stakeholders to coordinate joint responses to economic crime, including scams, fraud, financial crime, and banking-related cyber incidents.

For more information on the data and payment fraud trends, read the 2023 Australian Payment Fraud Report below and the accompanying media release.

- Fraud on lost and stolen cards increased by 44.5% to $41.8 million

- Counterfeit/skimming fraud increased by 30% to $7.1 million

- Card-not-present (CNP) fraud increased by 14.4% to $516.8 million

- Cheque fraud decreased by 24% to $2.4 million

Source auspaynet.com.au

For Australia’s financial sector, digital trust is the new currency

As adoption of banking apps grows, so does pressure to increase the range of capabilities the apps support, which has security ramifications.

Mobile app-based banking continues to find favour with Australians: more than two-thirds now use a mobile banking app or smartphone to do their banking, and it offers the highest customer satisfaction rating of any banking channel, averaging an 89.4% rating by customers of the ‘Big Four’.

As digital and self-service have been embraced by consumers, particularly in the form of increased use of apps, there’s inevitably pressure to build on that foundation.

A review of the apps of the five major Australian banks mid last year found customers wanted to see more capabilities and functionality added to the apps, particularly around money movement and management to improve financial wellbeing.

Some of these capabilities are being added in via third-party developed plugins created by fintechs, while other banks and credit unions are seeking to code these capabilities and features directly into the apps themselves.

Whichever app expansion strategy is pursued, a key concern will be that the additional functionality brings with it additional security risks. The larger the range of functions that the app can perform, the greater the amount of data it is likely to be handling.

All of these functions combine to create a broad potential attack surface for threat actors, who may view an ever-expanding banking app as a target that continues to increase in value.

Good security provides the confidence to expand apps

In a recent Deloitte survey, building digital trust was rated as the most important business strategy for success by financial institutions in the Asia-Pacific.

One of the top five benefits that cybersecurity investments had in this area was providing “confidence to try new things”, the survey found.

This means that at least in some banks, there’s a direct link between security and app capability growth; if a bank or credit union lacks confidence in their setup, they are less likely to try new things that could increase their security risk or exposure.

Banks and credit unions alike are acutely aware of their critical infrastructure role in Australia, and of the impact that a breach could have on customer confidence and goodwill. The critical nature of banking apps is often on display if they suffer downtime or degraded performance. Customer sentiment can turn quickly if they suddenly cannot perform critical tasks such as contactless payments at a supermarket register. And to be clear: these incidents aren’t often security-related. A security-related impact could prove catastrophic, particularly from an erosion of digital trust perspective, let alone what exposures individual customers could have.

Fortunately, credit unions and banking institutions tend to take a very proactive, best-practice approach to cybersecurity, and this extends to the oversight of their apps.

Many, for example, have focused on upskilling the defensive capabilities of their development teams. Without this education and verification, a lack of expertise may lead to teams taking shortcuts and/or lapsing into human errors, which could trigger configuration issues and code-level vulnerabilities.

Importantly for banks, these vulnerabilities could raise risk thresholds to a point that’s incompatible with, or in breach of, their regulatory requirements. Stringent regulations – including the Payment Card Industry Data Security Standard (PCI-DSS), the EU’s General Data Protection Regulation (GDPR) and additional global and national initiatives exist to address issues such as insecure data storage, insufficient authentication/authorisation, poor code quality and code tampering.

These standards create and drive vigilance among risk teams. In their pursuit of app expansion and increased customer satisfaction scores, it is important that developers or customer experience teams do not do anything that would undermine this vigilance and risk position.

Growing role-based security upskilling and awareness

To lay the foundations to proceed with banking app expansion with confidence, a holistic, people-driven security program is beneficial for creating the right mindset and foundational skills base.

A program that takes a dynamic approach based upon real-life threat management scenarios – as opposed to a static learning approach – will gain the most traction quickly. This can include the leveraging of motivational tools, such as rewards for successful “wins” and skills acquired.

Security learning pathways should also be available to everyone with a stake in the bank’s customer success. Developers are just one part of the ecosystem. Other parts of the organisation such as application security (AppSec) professionals and senior management also have key stakes in securing digital experiences and building digital trust. Executives, in particular, need to understand that security is not a “set it and forget it” discipline. A combination of tools and training is the most effective way to maintain the currency of security knowledge and best practices.

A positive security program focused on role-based education and awareness can lead to increased security engagement across the entire organisation, establishing the bank as “security-first.” From that position, unconstrained innovation can safely follow.

Written by Pieter Danhieux, CEO and Co-founder, Secure Code Warrior. Source: australianfintech.com.au

Anti-Scam Centre launches first ‘fusion cell’

The new National Anti-Scam Centre has launched its first so-called “fusion cell”, pulling together experts from regulators and industry to work on identifying ways of disrupting investment scams.

The Australian Competition and Consumer Commission, which operates the centre, announced yesterday that representatives from the ACCC, ASIC, banks, telcos and digital platforms will work on the project.

Fusion cells are “time-limited taskforces designed to bring together expertise from government and the private sector to address specific, urgent problems”.

The investment scam fusion cell will operate for six months and will target a number of goals: removing scam websites from the internet, stopping scammers reaching potential victims, sharing information about investment scams to assist the private sector to take disruptive activity; providing information to the public; and gathering intelligence to refer to law enforcement.

The ACCC said it will coordinate a series of these groups, with different participants, to target different types of scams.

The government announced in the May budget that it would provide A$58 million of funding for the centre over three years. Banks are expected to play a significant role in the centre’s work.

ACCC deputy chair Catriona Lowe said: “We’ll be using this funding to build the technology needed to support high-frequency data sharing with a range of agencies, law enforcement and the private sector.”

The funding was part of a package of measures announced in the budget, aimed at combatting scams and cyber crime. ASIC was allocated funding to allow it to identify and take down phishing websites and other sites that promote investment scams.

The Australian Communications and Media Authority was allocated funding to establish and enforce an SMS sender ID registry, aimed at impeding scammers seeking to spoof industry and government names in message headers.

Lowe said the Anti-Scam Centre will work with ASIC as it develops its scam website takedown service and support ACMA as it sets up the SMS sender ID registry.

Source: Banking Day, July 4, 2023.

BioCatch Behavioural Insights

Fraud Cases From the Wild

In our digital world, behaviour tells all.

The BioCatch Behavioural Insights Report presents an overview of fraud attack trends and insights collected by our Threat Analytics team based on their experiences working on the front lines with global customers. In these short stories, we highlight how BioCatch is delivering actionable behavioural insights to create trust and ease across the entire digital identity lifecycle.

Read the BioCatch Behavior Insights Report – June 2023 today

Orion protects Bank of us Customers

Tasmania’s Bank of us and its customers are reaping the significant fraud protection benefits of Indue’s Orion Financial Crimes Service, delivered as part of our exclusive full-service payments partnership.

As an agile solution that enables safer payments, ‘Orion’ offers real time, non-stop fraud detection, monitoring, and management through integrated AI machine learning.

Bank of us CEO, Paul Ranson said outsourcing payment services to Indue, including financial crime solutions and the provision of aggregated insights, predictability, and forewarning, has been of major benefit to the customer-owned bank.

“With Orion, more fraud cases are being detected and deterred before they hit accounts, drastically reducing our volume of disputes while simultaneously increasing our customer satisfaction and security,” Mr Ranson said.

“On the rare occasion fraud has transpired in the last 3 months since transitioning to a full-service partnership, Indue’s service has been incredible at enabling chargebacks to occur promptly, putting money back in our customers wallets faster.

“The necessity and truly incredible value of this service for Bank of us was illustrated when, on the first day of Orion’s operation at our bank, it saved just one of our customers $25,000.”

Indue CEO Derek Weatherley said the Orion service demonstrates industry-leading performance in financial crimes prevention, effectively reducing the burden on the non-major banks that we protect and serve, such as Bank of us.

“With more than 2.4 million accounts under management, Orion has access to a large pool of transactional data to detect trends, with rules tailored to meet the needs of individual organisations like Bank of us,” Mr Weatherley said.

“Our Australian-based team of fraud analysts do the heavy lifting, freeing up Bank of us to do the things they’re good at, like great banking products and services to Tasmanians, with enhanced peace of mind, knowing we’ve got them covered.

“For both Indue and Bank of us, who prioritise and care for customers, the reliable payments protection Orion provides is all that much more important.”

Beyond Orion, Indue’s range of services include the New Payments Platform, prepaid and gift card programs, mobile payments, the Nucleus Card Platform, and Payment and Bureau Services.

Bank of us upgrades fraud monitoring with Indue

As it targets August migration deadline.

Bank of us, a Tasmanian customer-owned institution, has signed Indue to upgrade its fraud monitoring, as it works through a broader payment migration project set for completion this August.

Bank of us has a retail presence in Tasmania and 33,000 customers.

The bank stated earlier this year it had invested in an upgrade to its fraud monitoring service, aimed at building greater protection for customer funds.

CEO Paul Ranson told iTnews the bank appointed Indue “as our exclusive full-service payments partner, which has included the adoption of Indue’s Orion financial crimes service.”

“The Orion financial crimes service monitors all card transactions in real-time, allowing for most fraudulent transactions to be detected and blocked before they hit our customer accounts,” Ranson said.

“The service will continue to be expanded to cover all other payment types from May,” he said, adding the financial crimes service is powered IBM’s safer payments platform.

He said since the upgrades, the bank has noted “a significant reduction in the number of fraudulent transactions affecting our customer accounts.”

Implementation of the financial crimes feature is part of a bigger project, kicked off last October, to migrate payment and settlement services over to Indue.

The project is expected to be completed by August 2023 and give customers access to more sophisticated end-to-end payment solutions.

Source: IT News, Apr 14, 2023:

Auswide Bank Partnership

21st March, 2023

Following the successful launch of a New Payments Platform (NPP) for Auswide Bank in 2022, Indue and Auswide have been busy behind the scenes to successfully implement Direct Entry, BPAY, Cards as well as Anti-Money Laundering (AML) and High Value payment capabilities.

Throughout the past year, Indue has enabled digital transformation, state-of-the-art customer experiences, and improved business outcomes for Auswide Bank, enabling them to best help achieve their goals of helping Australians achieve home ownership, create wealth, and access banking and financial services.

Auswide Bank Managing Director and CEO Martin Barrett said that Indue’s similar commitment to prioritising customers has assisted in delivering outstanding services to Auswide Bank communities and customers across the country.

“Indue’s full suite of end-to-end payment solutions are a key component of transforming our business with technology and providing digital payment choices for our customers, improving their experience and delivering stronger business outcomes,” Mr Barrett said.

“Efficiencies that have flowed through our operations as a direct result of Indue’s integrated service stack have exceeded all expectations – it is fantastic to have a partner with modern technology that does the heavy lifting for us”.

Indue CEO Derek Weatherley said “I am very pleased that this transition has closed so quickly and cleanly and my team remains energised to support Auswide Bank in bringing these services to their customers.”

“Since Indue’s appointment as Auswide Bank’s exclusive full-service payments partner earlier, we have expedited the implementation of NPP, Direct Entry, BPAY, Cards, AML and High Value payments” Mr Weatherley said.

“As a founding member of the NPP, our partnership with Auswide Bank enables the organisation and their customers to securely send and receive payments with other financial institutions in near real-time.

“Complementary to this, Direct Entry and BPAY provide cost-effective, convenient ways for customers to transfer funds between bank accounts and pay bills. The Indue and Auswide Bank relationship has been further enhanced by simple and adaptable payment card and mobile payment services, including switching and settlement, which provide maximum flexibility for Auswide Bank and their customers.

“The efficient and seamless implementation of these offerings demonstrates Indue’s industry-leading knowledge and ability to deliver cutting-edge integrated solutions to our customers.

“We are proud of the significant operational efficiencies that Indue’s integrated payment systems provide to Auswide Bank freeing staff up to focus on serving their customers and community. We very much look forward to continuing our successful partnership.”

Qudos Bank selects Indue as their principal payments partner

We are delighted to confirm that Qudos Bank has reappointed Indue as their exclusive full-service payments partner.

Qudos Bank is one of Australia’s largest customer-owned banks with branches in Sydney, Melbourne and Brisbane and more than $5 billion in assets, offering a full range of financial products and services, including home loans, personal loans, transaction, and savings accounts, super and investing, and insurance.

Over recent years Qudos Bank has been on a digital transformation journey and provides a host of exceptional digital banking platforms and payments services. Qudos Bank CEO Michael Anastasi said the relationship renewal reaffirmed the strength and value of the long-term partnership with Indue to provide end-to-end payment services.

“We have a long term partnership with Indue and renewing the relationship supports continuing development in our innovation around digital banking offering and providing a state-of-the-art payment services experience for our customers, underpinned by market leading security in payments for our customers” Mr Anastasi said.

“Importantly, Indue’s customer-focussed culture is outstanding across the organisation and directly aligns to our central focus as a customer-owned bank on delivering banking services in the interests of our customers, providing synergies that will help Qudos remain at the forefront of excellent in customer service standards for our customers across Australia.”

Indue CEO Derek Weatherley said the renewal of the partnership will enable Qudos Bank to provide to their customers a comprehensive suite of end-to-end payment services coupled with market leading payment security. Qudos has been remarkably successful through a laser focus on customer advocacy and being easy to do business with – the partnership with Indue ensures that excellence in customer outcomes remains at the forefront of their business operations.

“Indue remains heavily invested in advancements in our product technology capability, reinvesting our profits into research and development via our Innovation Hub and the various working groups it supports and continuing to support the digital transition of our clients,” Mr Weatherley said.

“We couldn’t be more pleased Qudos Bank has chosen to extend our long-term partnership and we are looking forward to working together to build out future innovation pathways for real time, data rich, frictionless payment choices for customers. Qudos has been a great supporter of their community and we look forward to working closely with Qudos this year on supporting and driving community focused outcomes important to their organisation.

“The payment products and services suite provided to Qudos Bank by Indue will include NPP, PayID & Pay To, mobile payments, Orion Financial Crimes, Cards, Direct Entry, and BPAY services.”

-ENDS-

Money20/20 – Identity

With the evolving world of payments and transactions providing a new frontier for digital criminals, financial crime has been a central theme of Money20/20.

The focus has been on opportunities and challenges posed by emerging technology in providing increased security and protection and the on-going convergence of cyber and financial crime.

Blockchain and crypto were resurgent topics and there were lively debates about the security implications of Web3 and questions posed on whether Blockchain makes fighting crime easier or harder – the jury is still out.

With much financial crime involving identity theft, and as we continue to watch what is unfolding back in Australia, online identity verification has been a hot topic. We’ve learned there are many ways companies can better structure their fraud control frameworks to protect themselves and their customers, including by deploying biometrics technology, identifying risks in customer onboarding, and increasing friction in authentication processes for higher risk transactions.

What is clear is the tactics used by digital criminals are vast and dynamic, from account takeovers to synthetic ID fraud, SIM swap, phishing attacks, address spoofing, online money laundering and global data breaches.

As we close out the first leg of our incredible innovation tour with our clients, we are reminded that to combat financial crimes consumer education and intelligence sharing and collaboration are critical.

Indue Partners with BioCatch: Fraud detection technology fighting back against financial cybercrime

Fraud detection technology fighting back against financial cybercrime.

A new partnership with leading digital security analytics provider BioCatch will integrate behavioural biometrics into Indue’s end-to-end payment solutions, providing customers with increased protection against financial cybercrime.

Behavioural biometrics technology empowers users of online banking to make secure transactions against the rising threats of cybercrime, which cost Australians more than $300 million in 2021.

Indue Chief Risk Officer Jane Hinton said the new partnership with BioCatch will enable Indue to tap into the value of world-leading fraud protection analytics technologies to enhance the safety, security and trust of customer’s online transactions and digital banking.

“In today’s digital world, detecting and preventing fraud & mitigating the impact of social engineering scams is important as ever, so we are very pleased to be partnering with BioCatch to integrate advanced biometric technology into our payment solutions,” Ms Hinton said.

“We want to minimise the risk and maximise the security of online banking and embedding BioCatch’s best-in-class behavioural biometrics technology into our end-to-end payment solutions will create a seamless and safe digital experience for users.

“Most importantly it will provide additional peace of mind that online transactions through Indue’s payment platforms are secure and safe from the ever-growing threats of online financial crimes.”

The technology works by continuously monitoring digital movements and looking for signs of fraudulent activity, which is pinged immediately once identified. The AI systems observe behaviour such as mouse movements, typing cadence and interactions with the screen to calculate a risk score and distinguish between genuine and criminal activity.

BioCatch specialises in behavioural biometric technology and provides banks with account takeover protection, mule account detection, social engineering scam detection and account opening protection, providing institutions with comprehensive insights to fight back against cybercrime.

Find out how our Financial Crime solutions can help your business.

The Rise of Fraud and Cybercrime

Payment providers are under pressure to ensure that customer demands for convenience don’t come at the expense of higher fraud and cybercrime.

.

Payment providers have long had to balance the trade-off between meeting mandated security requirements and providing convenience and the latest technology for consumers.

Over the past five to 10 years, this pressure has become more intense, as the demand for a wider variety of fast and convenient payment options. This, however, sometimes comes at the expense of security with criminals taking advantage of the situation.

Fraud and Scams in Australia

Australians lost a record $323 million to scams in 2021. Money lost to scams almost doubled in one year, with more than 286,000 Aussies reporting they were scammed last year.

These figures represent a ‘significant’ increase of 84% compared to 2020, when Aussies lost $175.6 million through the year.

Investment scams did the most damage according to the latest figures from the Australian Competition and Consumer Commission’s (ACCC) Scamwatch.

Investment scams accounted for $177 million, followed by dating and romance scams which saw people losing $52 million.

December saw the most money lost ($43.2 million) and August 2021 saw the highest number of scams reported (40,874).

New South Wales residents were collectively duped of $110 million – the highest, followed by Victoria where residents reported $74 million lost.

Crispin Kerr, Australia-New Zealand vice president at cybersecurity company Proofpoint, said the data paints an unfortunate picture of just how effective scammers were at taking advantage of Australians in the past year.

“The 84% increase in losses to scams in 2021 is significant and is just the tip of the iceberg when it comes to understanding the true impact on Australians,” Mr Kerr said.

“Based on the numbers for December, during the holiday season, people can become desensitised to receiving numerous advertising links for shopping deals and the like and may not think twice about opening a dangerous file or clicking a suspicious link.

“The data shows scammers were extremely active in 2021 and we anticipate this will only increase as scammers continue to evolve and update their tactics.”

How are Aussies getting scammed?

While investment and romance scams were the most damaging, there were a number of other scams that saw Aussies losing millions.

Investment scams accounted for more than half of all the money lost to scams last year, and increased in prevalence by 32% compared to 2020.

“Investment scams can seem very attractive, and scammers can come across as legitimate in their promise of financial gain through the purchase of shares, funds, cryptocurrency or other high returns,” Mr Kerr said.

“However, the reality is that these get-rich-quick schemes enable scammers to steal personal and financial information to siphon funds for their own gain.”

Social media sites were the main hub for money loss via romance and dating scams, with 40% of scams reported resulting in money lost.

“Scammers also utilised social engineering particularly during lockdowns when people were at their most vulnerable to steal millions from Australians in dating and romance scams,” Mr Kerr said.

Phishing scams – where scammers aim to gain personal information – had the highest number of reports in 2021, making up one quarter of all scams reported. This is an increase of 61% on the year prior.

Scams relating to threats to life or arrest disproportionately affected younger Australians aged 18 to 24 years old, and accounted for the highest losses at $3.3 million.

Employment and job scams also more than doubled in 2021 to $2.6 million, and identity theft scams increased threefold to $10 million.

Who is getting scammed?

Older Australians suffered the greatest loss according to the ACCC’s figures, with people over 65 years old losing a total of $81.9 million throughout the year.

This demographic also reported the highest number of scams (46,282), followed by Australians aged 35 to 4 years old with 43,526 scams reported.

Men lost more to scams than women, with men reporting $190 million lost compared to $131 million reported by women.

No age group was exempt from losing money to scams, but the amount lost to scams did increase with age in 2021.

Source: https://www.savings.com.au/news/scamwatch-2021

The risk of card-not-present transactions

When it comes to card fraud, however, card not present (CNP) transactions continue to dominate, making up 87% of total transactions. In 2019, AusPayNet launched the CNP Fraud Mitigation Framework to address and control this type of fraud.

Usually CNP fraud involves breaches by third parties, through hacking of IT systems of a retailer or other company. Stolen card details can then be stored by criminals and used well after the breach. Card on file transactions – where a customer keeps their card on file with a merchant they use regularly – are also becoming a preferred target of cybercriminals.

The good news about card fraud

Global fraud losses for card issuers, merchants and acquirers of card transactions from merchants and ATMs are large, totalling almost US$28 billion in 2018 – a huge increase from the US$7.6 billion lost back in 2010.[1]

Having said this though, in the past couple of years, the number of cases of payment fraud globally has been declining. This success has come through coordinated action within the payments industry, through measures including:

- a widespread roll out of chip and PIN (or chip and signature in the US) for card transactions at a physical point of sale (POS)

- the use of strong two-factor authentication for ‘card not present’ payments, as mandated in several countries

- improvements in fraud mitigation software, including the application of machine learning and artificial intelligence, and

- the roll out of tokenisation to protect card information held on file in databases and in mobile handsets.

The future of scams

Globally, the COVID-19 pandemic has seen a spike in scams seeking to exploit fears about the virus, which include targeting government payments and superannuation withdrawals. In Australia, just before the pandemic broke out in early 2020, there was also a spike in scam activity related to bushfire donations.

In response, governments and financial institutions are taking responsibility to educate themselves, consumers and businesses about the types of scams out there to help others avoid being exploited. They’re also doing more to identify and track account takeovers, shutting down “fake named” and “mule” accounts that scammers use to receive payments.

Predictions on fraud and scams are almost impossible to make, as criminals are always changing their methods and targets, partly to circumvent government efforts to address fraudulent activity. However, by having an action plan of “education, awareness and tracking”, governments, banks, consumers and businesses can take control to prevent themselves from being another scam statistic.

Looking ahead

As the world of payments continues to make strides forward, Australian consumers are likely to be at the forefront of the next evolution. At Indue, we help businesses adapt and meet the changing expectations of consumers, by delivering innovative, compliant and secure payment systems.

To learn more about the trends shaping the payments landscape and what it means for your business, contact us today

[1] Nilson Report, The Nilson Report Issue 1164, November 2019.

AusPayNet reminds consumers and merchants to be vigilant online as latest card fraud figures released

Data released today by the industry self-regulatory body Australian Payments Network (AusPayNet) shows a 9.2% rise in fraud on payment card transactions in the 12 months to 30 June 2021 (FY21) alongside an increase in online spending during COVID-19 lockdowns.

With total spending on cards rising 5.4% to $847.3 billion during the same period, the fraud rate in FY21 was 57.8 cents per $1,000 spent, up from 55.8 cents per $1,000 in FY20, but well below the rate of 73.8 cents in FY18.

Card-not-present (CNP) fraud – mainly affecting online transactions – rose 12.3% to $442.0 million in FY21 as e-commerce surged during successive periods of COVID-19 lockdowns in various parts of the country. In FY21, CNP fraud accounted for 90% of all fraud on Australian cards.

Lost-and-stolen card fraud dropped 9.2% to $28.0 million, and counterfeit/skimming fraud fell 37.3% to $8.9 million, an acceleration of a long-term downward trend for this type of fraud.

AusPayNet CEO Andy White said rising e-commerce volumes underscored the need for industry coordination to target the activities of fraudsters.

“Online transactions continue to grow strongly and inevitably this attracts the attention of organised fraud groups,” Mr White said.

“Industry-wide efforts to mitigate CNP fraud will remain critical, but we all need to remain vigilant when transacting online,” he said.

CNP fraud involves valid card details being stolen and used to make purchases or other payments without the card being present at the point of sale, usually online. Consumers are not liable for fraud losses on payment cards and will be refunded, as long as they take due care with their confidential data.

The end of FY21 coincided with the conclusion of the second full year of operation of the industry’s CNP Fraud Mitigation Framework. Under the Framework, merchants who consistently exceed agreed fraud threshold targets are required to introduce strong customer authentication. The Framework also encourages secure technologies such as real-time monitoring, machine learning and tokenisation.

“We expect to see the full benefit of the CNP framework as we emerge from the pandemic,” Mr White said.

Release of the latest payments fraud data comes soon after the inaugural meetings of AusPayNet’s Economic Crime Forum (ECF). As the successor to the Fraud in Banking Forum, the ECF brings together industry stakeholders to coordinate joint responses to economic crime including scams, fraud, financial crime, and banking-related cyber incidents.

“Alongside our focus on CNP fraud, last month we launched our scams strategy. Over the coming year we look forward to working with industry to reduce the impact of scams on vulnerable businesses and individuals,” Mr White added.

Consumers and merchants are reminded how they can be vigilant online in the lead up to the Christmas holiday season.

Steps consumers can take include:

- Only providing card details on secure and trusted websites – look for the locked padlock icon and be wary of offers that look too good to be true

- Treating unsolicited emails and text messages from people they don’t know with suspicion – don’t click on the link provided and don’t be tricked into divulging confidential data such as passwords

- Regularly checking statements and immediately reporting any unusual transactions to their financial institution

- Registering for, and using, their financial institution’s online fraud prevention solutions, whenever prompted

- Undertaking checks to ensure the online business with which they’re transacting is legitimate

- Always keeping PC security software up-to-date and doing full scans regularly.

Guidance for merchants:

- Use tools that help you authenticate your customers: a tool that supports risk-based authentication in the first instance, and strong customer authentication for transactions identified with a higher risk profile, is critical to reducing fraud.

- Invest in tokenisation: merchants holding sensitive account holder information can become targets for fraud. Tokenisation replaces this information with a unique digital identifier (a token).

- Regularly speak to your acquirer and gateway providers about what you can do to secure your business.

Orion Financial Crimes – Case Study

Fighting financial crime with award-winning technology

Orion Financial Crimes – Case Study

The growing sophistication of financial crime remains an ever-present threat, particularly as we move to a predominantly cashless society, and engage with more ways to pay. Left exposed or unprotected, fraudsters can swiftly take their toll on financial institutions’ bottom line and reputations.

To stay on top of innovative financial crime perpetrators, financial institutions must have the best people, processes and technology in place to efficiently detect and monitor fraudulent behaviour. This valuable mix can sometimes take years to develop without the support of specialist providers.

Financial institutions are often faced with having to run multiple, costly technology solutions that tackle independent payment channels. This can lead to siloed people and processes supporting these multiple solutions. Managing multiple solutions also runs the risk of delaying the detection of fraud and potentially missing a fraud event entirely, exposing vulnerabilities for fraudsters to exploit.

These were just some of the challenges Indue’s client — a well-known Australian bank — faced while attempting to protect its 400,000-plus customer base prior to engaging Indue’s financial crimes experts.

Results we achieved for a leading Australian bank

-

50% cut in fraud losses in the first month

-

60% reduction in false-positive fraud results

-

400,000-plus customers better protected

Challenges

As a leading Australian bank, reliable fraud monitoring was essential to keep up with the fast, real-time transaction speeds of today’s payments networks. The bank was fighting fraudsters without the ability to decline in-flight transactions in real time, the outcome was fraudsters had the opportunity to achieve far greater attacks utilizing velocity and speed to their advantage.

The bank’s incumbent technology was also returning significant false-positive fraud results, thereby clouding analyst assessments and creating cost inefficiencies for operations. This enabled real fraud to hide behind genuine behaviour, which was often missed during assessments.

Critically, fraud was being monitored only during office hours by the client’s operations team. This often resulted in a backlog of events for next day review, while providing an opportunity for perpetrators to schedule attacks during out of hours and unmonitored periods.

How Indue helped: 5 key priorities

Shared vision: Indue’s financial crimes experts were able to see the bigger picture and work in partnership with the bank on their longer-term business planning goals and objectives, to provide a solution that could grow and adapt over time.

Partnership: The client was seeking a supplier who would take a true partnership approach. A partner who could work with them to co-create an integrated solution that could simplify the management of multiple payment channels and return better results than its existing provider.

Partnership: The client was seeking a supplier who would take a true partnership approach. A partner who could work with them to co-create an integrated solution that could simplify the management of multiple payment channels and return better results than its existing provider.

Collaboration: A key success factor was the focus on collaboration between the client and Indue. The teams worked closely to ensure each other’s strengths were being leveraged, that the client was listened to and understood, that there was clarity on the problems that needed solving, and that there was alignment on identifying technical challenges and key performance outcomes.

Understanding: Built on years of experience, the Indue team understands that the closer you can work with a client’s team, the better the outcome. It was through establishing a close working relationship Indue was able to provide direction & guidance to help them decide how they wanted and needed to interact with the service. As the client was reshaping their own fraud management approach, Indue was able to provide guidance and counsel.

Feature Rich Service: The bank required a 24×7 alert triage service thereby providing round the clock monitoring and protection for their 400k+ customer base. Powered by award-winning IBM Safer Payments, the Indue solution was able to reduce the risks associated with the client’s multiple payment channels. Further, Indue’s investigation Case Management tool made an outsourced service much easier to manage back in the clients own shop. Finally, the Indue aggregation model was able to deliver insights from across a broad range of industry financial crime learnings, providing the client with greater visibility of the financial crime landscape.

“Financial crime is a unique, fast-paced and often highly complicated problem to solve. It requires people, process and technology working together harmoniously to achieve results.”

Dean Wyatt, Head of Financial Crimes, Indue

Results, return, future plans

Following the implementation of Orion Financial Crimes Solution, the bank saw immediate results with card fraud losses cut by 50% in the first month alone. More fraud was detected through less alerts and false-positives reduced by 60%.

Better outcomes overall were achieved in prevention and detection by addressing both fraud and scams, and significantly reducing chargebacks to customers.

The bank is now looking to add further payment channels to Indue’s solution, taking full advantage of the single-view capability of Orion Financial Crimes and IBM Safer Payments.

Critically, the bank can now focus its attention on higher value programs to drive its customer-first value proposition while working with Indue to protect its customers.

Orion Financial Crimes

Orion Financial Crime’s ability to inherently integrate people, processes and technology provides a cutting-edge solution with real-time capability, integrating artificial intelligence and machine learning to deliver a 24/7 fraud monitoring solution.

Launched in 2003, Orion Financial Crimes went live with IBM Safer Payments in 2018, providing real-time fraud & scam detection and management, anti-money laundering and counter-terrorism financing monitoring, sanctions checking across Australia and New Zealand.

Launched in 2003, Orion Financial Crimes went live with IBM Safer Payments in 2018, providing real-time fraud & scam detection and management, anti-money laundering and counter-terrorism financing monitoring, sanctions checking across Australia and New Zealand.

To find out how you can tap in to Indue’s team of experts & specialists in fraud management contact us today.

Top three 2020 financial crime trends

Top three 2020 financial crime trends

The global pandemic and subsequent economic downturn has presented a new set of challenges for financial institutions

The global pandemic and subsequent economic downturn has presented a new set of challenges for financial institutions as they work to keep pace with financial crimes across the sector. With advancements in technology, changes in human behaviour and an increase in vulnerability as a result of COVID-19, it has never been more important for organisations to remain ahead of the financial crime curve and put up a solid defence in a post-pandemic world.

As the nation continues to navigate the ‘new normal’, we took a look at the top three financial crime trends of 2020 with Indue’s Financial Crimes team as a friendly reminder to stay vigilant and safeguard against professional perpetrators.

1. Rise of ecommerce

There’s no doubt the way we choose to pay has materially changed since the onset of COVID-19. With lockdown restrictions across the country, we’ve seen traditional brick and mortar stores exchanged for convenient and contactless ecommerce channels.

As a result, ATM withdrawals and cash-out transactions have dropped considerably, with the RBA reporting a 52% and 30% decrease respectively for the quarter ending June 2020.

Meanwhile, a recent report by Australia Post revealed ecommerce has grown by a mammoth 80% year on year in the eight weeks since COVID-19 was declared by the World Health Organisation, with an average of 2.5 million households buying something online each week in April 2020, compared to 1.6 million in 2019.

This significant shift to online transactions has seen a corresponding increase in online fraud. Indue’s Head of Financial Crimes, Dean Wyatt, said the company’s internal fraud metrics in relation to ecommerce had reported a 28% rise to 98% since the global pandemic hit.

“With an increase in online traffic comes an increase in fraud associated with ecommerce merchants, putting customers’ personal details at risk,” he said.

“On the other hand, we’ve seen instances of petty theft and stolen cards decline as a result of restrictions such as curfews and people generally travelling less, including people shifting to working from home arrangements.

“The good news is we’ve been able to hone in on this change using our multi-channel Orion Financial Crimes service, and align our analytics to identify and track suspicious behaviour in real time, to ensure our customers remain protected.

“Customers need to be aware that if they’re using new types of payments, they need to be following the same rigor as you would when paying instore.”

2. The art of social engineering

Social engineering by definition seeks to exploit human psychology to access and obtain personal information, and it’s this type of scam that continues to outsmart targets.

From phishing attacks (fraudulent emails or texts that appear to come from a reputable source) to baiting (a false promise to pique a victim’s greed or curiosity), the goal of the ‘social engineer’ is to trick individuals into giving up sensitive information or visiting malicious URLs to compromise their systems.

“We have seen a strong shift to perpetrators compromising people directly and involving them in the scam, rather than solely relying on targeting accounts or cards,” Dean said.

“Compromising identity details across driver licences, passports, and email or social media accounts is hot property at the moment because financial services are inherently integrated with those types of documents, information and platforms.

“People are fooled by sophisticated attacks that purport to ‘know you’, calling with pieces of information already collected, with the intention of gathering further details from the victim. When scammers are able to access detailed personal information, they can easily create new accounts or lines of credit under individuals’ names.

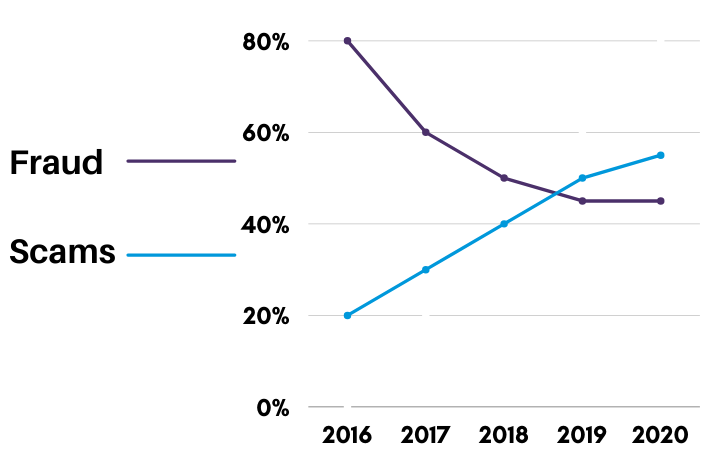

“At Indue, we have seen a considerable rise in social engineering over the last four years, to the point where it is now a larger problem than fraud. In 2016, financial crimes represented 80% fraud compared to only 20% social engineering scams, but as of 2020, we’re now seeing 45% fraud compared to 55% scams.”

“At Indue, we have seen a considerable rise in social engineering over the last four years, to the point where it is now a larger problem than fraud. In 2016, financial crimes represented 80% fraud compared to only 20% social engineering scams, but as of 2020, we’re now seeing 45% fraud compared to 55% scams.”

According to the Australian Payments Network, the most common contact method for scam activity in Australia is by email, but scams via phone result in the most financial loss.

3. Money laundering and terrorism financing

A key focus for institutions and regulators has been the growing trend of traditional financial crimes, like money laundering and terrorism financing, with both AUSTRAC and the Financial Action Task Force (FATF) reviewing controls and payment systems to identify potential weaknesses that could be exploited by criminals across the sector.

Money laundering seeks to disguise the proceeds of crime as legal income, while terrorism financing, as the name suggests, funds terrorist activities, both of which have the potential to trigger global repercussions.

Tough financial penalties have been handed down in recent times — the Commonwealth Bank of Australia and Westpac have both been hit with fines totalling $2 billion relating to serious breaches of anti-money laundering and counter-terrorism financing laws.

“With the shift of payments to a digitized world, more criminals are taking advantage of the opportunity to leverage these methods and innovative ways of sending financial transactions to each other,” Dean said.

“The rise of financial crime and the importance of protecting payment ecosystems has never been more important. With AUSTRAC’s presence increasingly felt in Australia over the last few years, I see it remaining a consistent focus beyond 2020.

“Genuine customer behaviour is certainly playing into it as well — with a strong shift to online payments, criminals are increasingly moving from hard cash to online transfer methods and attempting to hide between the genuine customer activity.

“As part of our Orion Financial Crimes solution, our anti-money laundering and counter terrorist financing service monitors customer account behaviour and transactions for unusual patterns, to detect activity that may be reportable under the Australian Anti-Money Laundering and Counter Terrorist Financing Act.”

Find out more

Learn more about Indue’s Orion Financial Crimes service, a multi-channel detection system that harnesses transactional data, customer behaviour and biometrics to expose anomalies and identify fraudulent activity. Delivered by an expert team, the service is forward-thinking with a machine learning/artificial intelligence component and places customers ahead of the curve, providing a safety net when it comes to material risks and losses.

customer behaviour and biometrics to expose anomalies and identify fraudulent activity. Delivered by an expert team, the service is forward-thinking with a machine learning/artificial intelligence component and places customers ahead of the curve, providing a safety net when it comes to material risks and losses.

References

1. https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

2. https://auspost.com.au/content/dam/auspost_corp/media/documents/2020-ecommerce-industry-report.pdf

3. https://www.auspaynet.com.au/sites/default/files/2020-08/Fraud_Report_2020.pdf

AusPayNet 2020 Payment Fraud Report – Fraud Statistics Jul 19 – Jun 20

AusPayNet 2020 Payment Fraud Report – Update

AusPayNet has released their latest 2020 fraud statistics, indicating that Industry effort drives continued decline in card fraud.

Auspaynet Releases Fraud Statistics Jul 19 – Jun 20

2020 Fraud Statistics released December 2, 2020 by the industry self-regulatory body Australian Payments Network (AusPayNet) show fraud on payment card transactions declined 15.4% in the 12 months to 30 June 2020 (FY20).

The following article has been sourced from AusPayNet’s website.

Continued decline in card fraud

The fraud figures for the 12 months to 30 June 2020 (FY20) show fraud on payment card transactions dropped by 15.4% to $447.2 million continuing the trend recorded in the 2019 calendar year.

Within this total:

- Card-not-present (CNP) fraud – affecting mainly online transactions – dropped by 14.0% to $392.4 million.

- Lost and stolen card fraud dropped by 28.5% to $30.8 million

- Counterfeit/skimming fraud fell be 24.8% to $14.0 million

The decline, which came as spend on cards totalled $803.4 billion (up 0.5%), translates to a rate of 56 cents per $1,0000 – down from 66 cents per $1,000 in FY19.

The FY20 data includes the first full year in operation of the industry CNP Fraud Mitigation Framework, which came into effect on 1 July 2019.

Download the 2020 Payment Fraud Report & Latest Fraud Stats:

For more information on the data and payment fraud trends, including a “Spotlight on Scams”, read Auspaynet’s 2020 Payment Fraud Report here.

You can also read their December Media Release and Payment Fraud Stats July 19-June 20.

Article & Image Source: Australian Payments Network (Auspaynet)

InFocus Cyber Security Interview

Is there a risk that security is compromised when providers compete on convenience?

Cyber security interview with Dave Hemingway by Lance Blockley, InFocus

Emerging Payments Association’s InFocus takes a look at Cyber Security, a theme that is more important than ever, following the wide-scale shift to remote working, and the increase in usage of e-commerce and digital identity.

Emerging Payments Association’s InFocus takes a look at Cyber Security, a theme that is more important than ever, following the wide-scale shift to remote working, and the increase in usage of e-commerce and digital identity.

In this first interview for InFocus, Lance Blockley is talking to Mani Amini CEO at Secure Forte and Dave Hemingway CCO at Indue.

Indue gains ISO certification for information security management

Indue gains ISO certification for information security management

Indue has received an International Organization for Standardisation (ISO) 270001:2013 certification for information security management — one of the most widely recognised and internationally accepted standards for the security of assets.

ISMS Continual Improvement

The ISO certification features requirements on how to implement, monitor, maintain and continually improve an Information Security Management System (ISMS) in accordance with the standard, including preserving the confidentiality, integrity and availability of information to ensure risks are adequately managed.

Indue Chief Executive Officer Derek Weatherley said the accreditation reinforces the organisation’s proven security processes and credentials against the global standard.

“This is a significant achievement for Indue, which specialises in helping customers gain competitive advantage through innovative payment solutions,” Mr Weatherley said.

“The certification strengthens our approach to information security, and demonstrates to our customers and partners that we maintain the highest levels of data security.

“We are trusted by our customers to store and process their most valuable data, so this certification provides assurance that we have all the necessary controls in place to ensure this important information is protected.

“Particularly in the context of COVID-19 where we’ve seen an increase in the risk of data security breaches alongside a surge in online transactions, we’ve continued to demonstrate our commitment to secure payment products, supported by rigorous compliance, program oversight and our transaction monitoring and protection system, Orion Financial Crimes.”

Data security has never been more important, with COVID-19 restrictions forcing many businesses to move to remote data almost overnight, significantly increasing the risk of data breaches.

By implementing and following the necessary steps to comply with the ISO 27001:2013 standard, organisations can identify, control and eliminate security risks, ultimately certifying the security practices adopted within the organisation.

ISO is an independent, non-governmental, international organisation that develops standards to ensure the quality, safety and efficiency of products, services and systems.

IBM Safer Payments – Indue’s fraud monitoring platform wins Award

IBM Safer Payments, Indue’s fraud monitoring platform, voted best in Asia

The next generation platform powering Indue’s Orion Financial Crimes fraud monitoring solution, has been recognised at the Asia Risk Technology Awards 2020.

Fraud Detection & Prevention Product of the Year Award

IBM Safer Payments, the next generation platform powering Indue’s Orion Financial Crimes fraud monitoring solution, has been recognised at the Asia Risk Technology Awards 2020 as Fraud Detection and Prevention Product of the Year.

The Awards, recently held in Singapore, are the longest-running and most prestigious in the region, recognising vendors that deliver innovative and forward-thinking technologies to meet the financial services industry’s complex challenges.

IBM Safer Payments won the award specifically for bringing agility to combatting fraud and for its differentiated capabilities — a solution that is particularly well positioned to serve Australian clients as disruptions associated with faster payments and the emergence of challenger banks gathers momentum.

Commitment to Next-Gen Risk Solutions

Indue’s Chief Commercial Officer, Dave Hemingway, said this important industry acknowledgement for partner IBM demonstrates Indue’s commitment to bringing next generation risk and compliance solutions to serve Australian customers, and to meeting their specific industry and business needs.

“We began leveraging IBM Safer Payments in 2018 as part of our Orion Financial Crimes service, to reduce the risks associated with the introduction of the New Payments Platform — with real-time payments comes a greater risk of fraud and cyber crime,” Mr Hemingway said.

“Indue is now using IBM Safer Payments to its full capacity and we’re seeing incredible benefits as a result.

“The pace of change within the industry, particularly due to COVID-19 where we’ve seen a significant move to online transactions, has meant we’ve been able to harness the capability of IBM Safer Payments, and adjust and adapt to meet these changes in behaviour, fast.

“It’s reassuring to know that what we’re doing and the tools we’re using in the financial crimes space is backed by world-leading, award-winning technology and we’re proud to be leading the way.”

24/7, Australian-based Fraud Monitoring Solution

Indue’s Orion Financial Crimes solution integrates artificial intelligence and machine learning algorithms to deliver a 24/7, Australian-based fraud monitoring solution, powered by IBM Safer Payments.

With the integration of IBM Safer Payments, the Orion Financial Crimes team has experienced a 20% reduction in false-positive rates, and have been able to make rule changes up to 90% faster when compared to traditional platforms, while managing all payments channels in the one system.

Indue consistently outperforms the industry average in financial crimes prevention, offering credible, major bank grade anti-fraud capabilities for small to mid-tier banks.

Find out more about Indue’s Orion Financial Crimes Service.

5 Trends influencing payments by CEO Derek Weatherley

The top five payment trends influencing 2020

The digitisation of payments, changes in ecommerce and acceleration of mobile wallet adoption are global payments trends in 2020 challenging the industry to keep pace. These trends are not only forcing businesses to change the way they operate, but are also putting data security at the forefront of business strategy.

With the future of payments quickly coming into focus — thanks in no small part to the impact of COVID-19 — Indue CEO Derek Weatherley shares his insights on the top five payment trends influencing 2020.

- The ecommerce experience and embracing the evolution

Even prior to the COVID-19 pandemic, ecommerce was expected to continue to grow rapidly in 2020. But restrictions and public space shutdowns have significantly changed consumer behaviour, with a 29 per cent increase in ecommerce spending locally month-on-month since lockdowns began in March1. On the other hand, physical transactions have decreased and people are using less cash — a longer-term trend accelerated by the global pandemic as some businesses discourage the use of cash.

Helping drive this trend is a population seeking more flexible and convenient ways to pay. Combine this with confidence in stronger digital security and a willingness within the retail sector to embrace technological change, Australia is starting to see mobile payments take off. In 2019, The Reserve Bank of Australia reported 83 per cent of point-of-sale card transactions were contactless payments, signifying a rise of almost 20 per cent in three years2. COVID-19 is only adding to this rise with the payments industry temporarily increasing the contactless card PIN limit from $100 to $200 to minimise physical contact with the payment terminal and help reduce the risk of COVID-19 transmission.

One trend to keep a close eye on is the digital wallet. Roy Morgan’s latest Digital Payments Report revealed that digital wallets such as Apple Pay, Google Pay and Samsung Pay are being used by roughly one in 10 Australians (9.8 per cent) — up from 6.8 per cent a year ago3. This upward trend will continue, but the mobile wallet race hasn’t fully played out just yet as the industry looks to cater for all the different use cases.

One thing is clear — the payment industry will continue to evolve to meet the needs of merchants as consumers demand improvements to the overall ecommerce and contactless experience.

- Congestion, Competition and the Customer Dollar

It’s a busy time for payment systems operators, with heightened conversation taking place across payment schemes in the industry. We’ve also seen in recent times a significant transformation of the base-level clearing and settlement capabilities, causing disruption for many in this space and providing future innovative payment solutions.

The high level and pace of change is causing congestion and headaches for financial institutions and payment providers. As older forms of payment are migrated, schemes are coming into competition with each other, creating congestion and ultimately higher costs for consumers.

This will likely settle in the next three to five years as the industry settles on its future scale approaches to utility payment processing, but the medium-term landscape remains challenging and costly.

Understanding what’s next in payment industry platforms comes down to understanding the value proposition in the eyes of consumers and merchants and their respective appetite to pay. We expect to see competition between providers of closed and open payment platforms increase, as they contest for a larger slice of their customer dollars and loyalty4.

- Money moves fast and attacks are evolving

Data security in the world of payments has never been more crucial and with innovation comes security issues as payment products and services evolve. The speed of transactions have increased through advancements like New Payments Platform (NPP) real-time payments, and we are exposed to significantly larger and more valuable data footprints online, which all contribute to a heightened risk of fraud. By investing in sophisticated machine learning payment technology, Indue now has the capacity to draw from a much larger pool of data and undertake significantly more sophisticated real time analysis to detect trends that benefit — and protect — each individual client.

Indue’s Orion Financial Crimes solution integrates human and artificial intelligence (AI) with machine learning algorithms to deliver a 24/7 fraud monitoring solution. This solution provides a broad gambit of services, including real-time fraud and anti-money laundering monitoring across all payment channels. This is a significant shift in how financial institutions trade on trust, and therefore need to put reputation and security at the forefront of their business priorities. Without robust data security measures, businesses run the risk of damaging their brand and making consumers feel uncertain about the safety and security of their accounts.

We have transformed our financial crimes services and continue to invest in leading-edge payment technology to better monitor trends and ultimately protect our customers from fraud. Assurance of identity in a virtual world is another key area of focus in an increasingly digitised world and an area where we are assisting our customers to adapt to with ongoing innovation in this area.

- Less friction, more function

Product commoditisation will not only challenge business models, but shift the economic climate, especially in the banking and fintech sector. Digitisation and ease of payments have changed the way customers think, decreasing the value of traditional competitive differentiators in the process — payments are now instantaneous, simple and 24/7.

As consumers become more and more accustomed to these seamless transactions, it presents a challenge to providers who need to balance the cost of creating a frictionless experience and meeting consumer expectations. Expect to see structural shifts among the players operating in this environment as they look to drive revenue through new or enhanced customer experiences, and make use of data analytics to anticipate customers’ changing needs and expectations4.

- Wake up to new ways

COVID-19 has made embracing and adapting to the work-from-home environment a must for businesses. The shift has provided opportunities for businesses to expand their workforce and recruit talent from anywhere, as most payment organisations aren’t restricted by location.

Even before COVID-19, Indue embraced work from home and flexible working hours, revising the way we manage talent to reap the positive benefits of a geographically dispersed workforce and provide an increased work/life balance across the organisation.

The final word — what do these 2020 payments trends mean for our customers?

Our customers rightly focus their investment dollars on driving the top line, and leave the distraction of digitisation and changing payment rails to us to handle on their behalf. However, with continued evolution of the online world, it’s important that our customers sensibly invest in the modernisation of their platforms, particularly those platforms that make their customers lives easy. They don’t need to be on the leading edge, but do need to keep pace.

References

1 https://www.adnews.com.au/news/online-shopping-orders-have-increased-49-this-year

2 https://www.mobiletransaction.org/au/tap-and-go-trending-in-australia/

3 http://www.roymorgan.com/findings/8308-digital-payment-solutions-december-2019-202003100329

AusPayNet 2020 Payment Fraud Report Released

Australian Payments Network 2020 Payment Fraud Report

AusPayNet has released their annual Payment Fraud Report, showing data and payment fraud trends.

Auspaynet Report Shows Card Fraud Declines Sharply

The Australian Payments Network’s 2020 Payment Fraud Report shows that in 2019, card fraud fell by 19.5% to $464 million – the biggest decline ever – as total card spending rose 3.9% to a record $819 billion.[/vc_column_text][vc_column_text]This translates to a fraud rate of 56.6¢ per $1,000 spent, a significant drop from 73.1¢ per $1,000 in 2018.

- Fraud on Lost and Stolen cards fell by 37% to $35 million

- Counterfeit /Skimming fraud fell by 14.3% to $16.8 million

- Card-Not-Present fraud fell by 17.7% to $402.6 million

The drop in card-not-present (CNP) fraud, mainly affecting online transactions, is the first ever and coincides in part with the introduction in July 2019 of the industry CNP Fraud Mitigation Framework.

The industry is committed to tackling CNP fraud, which accounts for 87% of all card fraud, and remains vigilant as e-commerce volumes increase during the COVID-19 pandemic.

Download the 2020 Payment Fraud Report:

For more information on the data and payment fraud trends, including a “Spotlight on Scams”, read Auspaynet’s 2020 Payment Fraud Report here.

You can also read their Media Release and Payment Fraud Stats Jan-Dec 2019.

Article & Image Source: Australian Payments Network (Auspaynet)

Tokenisation – What is it and can it beat payment fraud?

Tokenisation – What is it and can it beat payment fraud?

Tokenisation seems to be one of the key buzzwords in the payment industry at the moment. However, what does this concept really mean and how does it benefit payments made today?

What is Tokenisation?

Tokenisation is a method of protecting sensitive data by replacing it with an algorithmically-generated number referred to as a ‘token’. In the payments world, tokenisation is commonly used to replace debit and credit card numbers in an attempt to prevent card fraud.

Under this form of tokenisation, a cardholder’s Primary Account Number (PAN) is replaced by a random number that is not linked to the card number prior to processing a transaction through the payments network. This process assists in mitigating the risk of exposing sensitive card data to unauthorised individuals or software that could potentially exploit the data by fraudulently duplicating the card details. It also prevents merchants from storing the PAN in databases, which are targets for hackers. Tokens cannot be decrypted or reverse-engineered. The only relationship between the original card number and its associated token number resides within the Token Service Provider.

What is a Token Service Provider?